In my continuing series about calming the overwhelm and creating balance in all 7 major areas of life, can we talk about a significant pain point for most people?

Yeah, it’s . . . money.

If lately you’ve been stressed over credit card debt, fighting about household spending, or worried about how you’re going to pay your bills, you could probably use a lot more balance in the area of finances.

Of course, the recent economic upheaval hasn’t helped. But the reality is that some people sail through tough economic times with a healthy emergency fund, little to no debt, a side hustle that pays household expenses, and a lifestyle they can dial down at a moment’s notice.

For others, an economic crisis like this one is a wake-up call that their finances may not have been great to begin with.

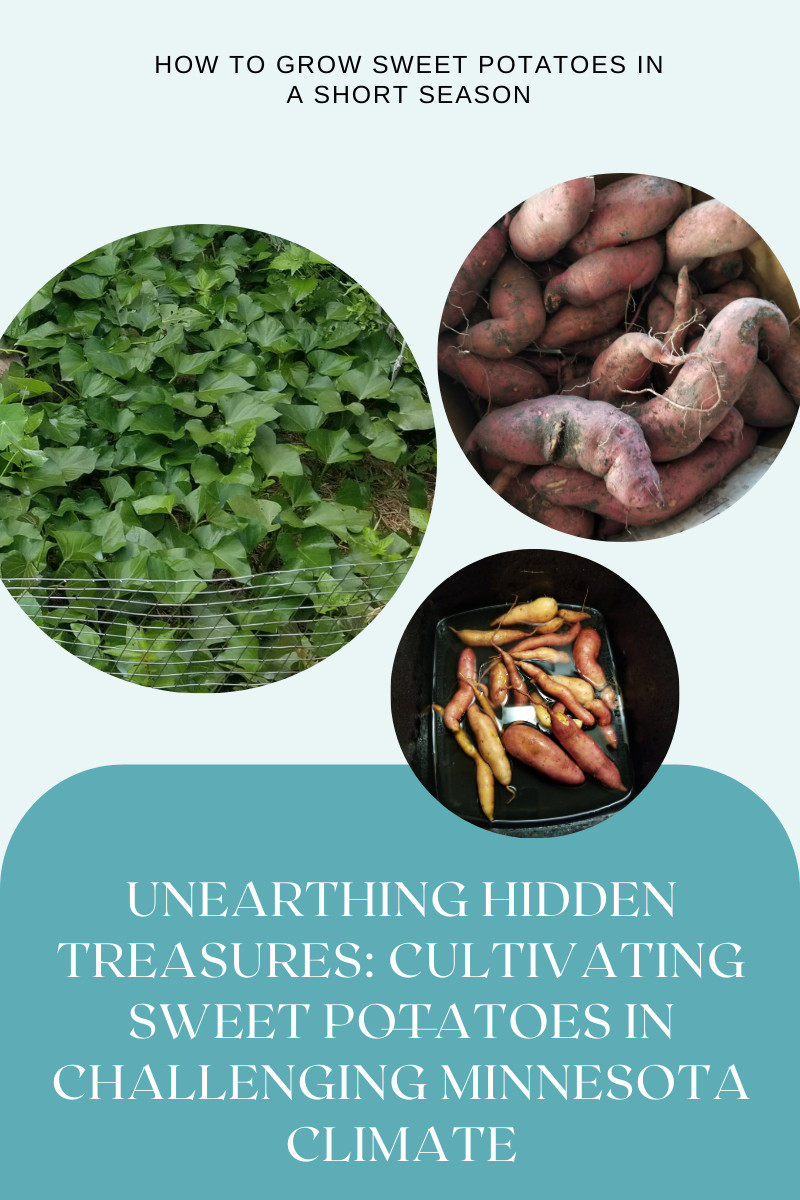

If you grow anything in a garden like I do, you may identify with this… Plants starting out in the spring in wet rainy conditions will grow shallow roots, expecting the constant water level to always be available. Plants starting out in a spring with dry conditions will grow deep roots looking for water and building a strong foundation to withstand the rest of the season no matter what the weather brings. If this past year for you was like mine, realising your roots were not deep enough, I would love to help you start to build that deeper foundation.

If this is you, why not consider what you can do today to bring balance to your finances. Could you . . .

• Slash your expenses to absolutely necessary costs only?

• Sell unused items on Craigslist or Facebook Marketplace?

• Look for work-at-home gigs for extra money?

• Build a rainy-day savings account with just $100 to start?

Be Accountable for Your Financial Future

While a dire financial situation may seem impossible now, solid finances are possible if you create a plan and focus on making small steps regularly.

Start the month with a budget and stick to it.

Write down all your debts and start paying them off, starting with the smallest one.

Start a second income stream to fund savings or retirement.

Get investment help from a professional financial planner you trust.

Talk with your spouse and kids about cutting back and saving up until you’re feeling better about your finances.

Then, seriously consider working with me privately to set financial goals and be accountable for reaching them. Helping people find balance and achieve life changes in every major area is something I do through a unique 10- week coaching program designed around the bestselling book and coaching formula: Oola.

We recently added a 3 week intensive coaching program specifically to focus on your finances, The Green Gap. Discover the formula that Dr. Troy used himself to get out of debt and retire by 42 and start growing your roots deeper into that new foundation going forward in your finances this year.

Message me for details. Then let’s jump on a discovery call about what coaching can do for you.

For inspiration watch this interview of one couple who paid off $80,000 in debt in 2020. https://www.facebook.com/OolaLife/videos/710557276330220

0 Comments